If you are looking for ways to get out of debt, you came to the right place. This isn’t an ordinary article about cutting coupons to save money at the grocery store.

And it’s not going to tell you to ditch your car payments to help you get out of debt. After all, you probably need that car to get to work.

Nope!

This is an article about how to get out of debt by comparing your bills, income, and net worth with others.

Ten years ago it would have been almost impossible but now you can use the wisdom of the crowd to improve your financial situation using a pioneering financial app.

Here’s how…

Are You Paying Too Much?

Back in the old days, it was almost impossible to know whether you were paying too much when compared to your peers.

Sure, you could compare your credit scores with national average figures.

And maybe you could compare your salary with the amounts earned by others in your same profession, but that was about the limit of the information you could view on others.

If you wanted to know whether you were paying too much to your Utility provider compared to your neighbors, it was nearly impossible to know.

But maybe paying an extra few bucks more than your neighbor to your cable provider each month isn’t a big deal.

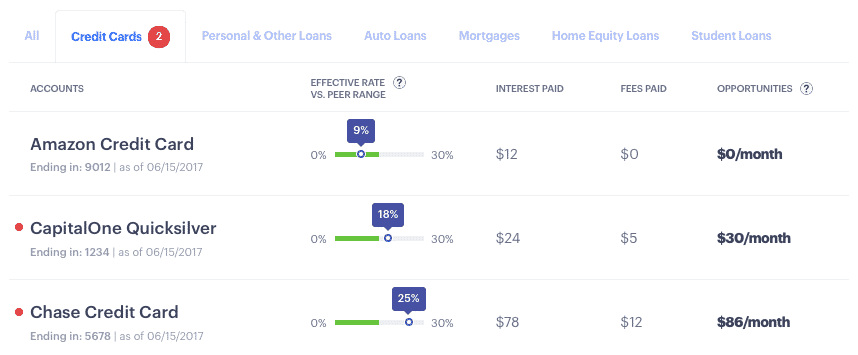

However, it is a big deal when you are paying higher interest rates on your credit card balances compared to your peers.

The power of compounding means that over time you end up saddled with ever more debt while others who regularly pay off debt balances reach financial freedom.

So how do you find out what your neighbors and peers are paying without knocking on their doors and asking them point blank?

We found a great app that was custom-built to help you find out whether you are paying too much so you can lower your expenses and ultimately get out of debt.

Its name: Status Money, or simply Status.

| STATUS MONEY SPOTLIGHT | |

InvestorMint Rating 4.5 out of 5 stars |

via Status Money secure site |

Compare Yourself To Your Peers & Lower Your Bills

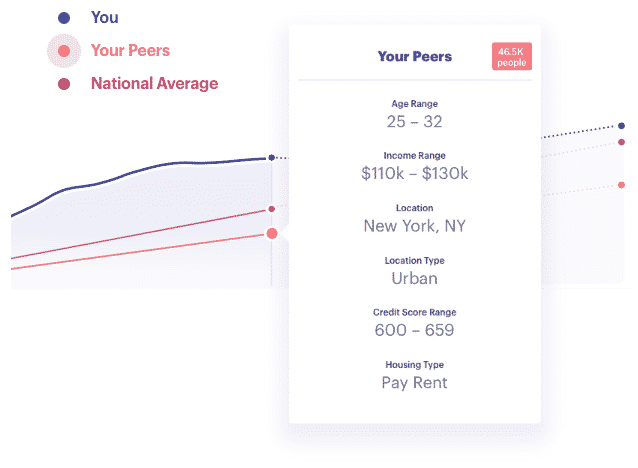

Status helps you to manage your finances using big data aka the wisdom of the crowd.

Another way of saying that is Status allows you to compare your finances with those of others.

You don’t have to worry about data privacy because each individual user’s information is anonymized.

It’s easy to compare yourself to people of the same age, income type, location, house type, and even credit score range.

Instantly, you can see whether your debts are higher than those of your peers.

Lots of other valuable information is available too, like whether you are being nickeled and dimed by financial service providers who hit you with extra fees.

And you can find out quickly whether the interest rates on credit cards that you are paying are higher than the rates paid by others.

But if all Status did was compare your financial situation to peers, it may not be all that useful, even if it were voyeuristically intriguing.

Which is why Status earns high marks for helping you to take the next steps to lower your monthly costs.

By showing you Opportunities, Status points you in the right direction to improve your financial situation.

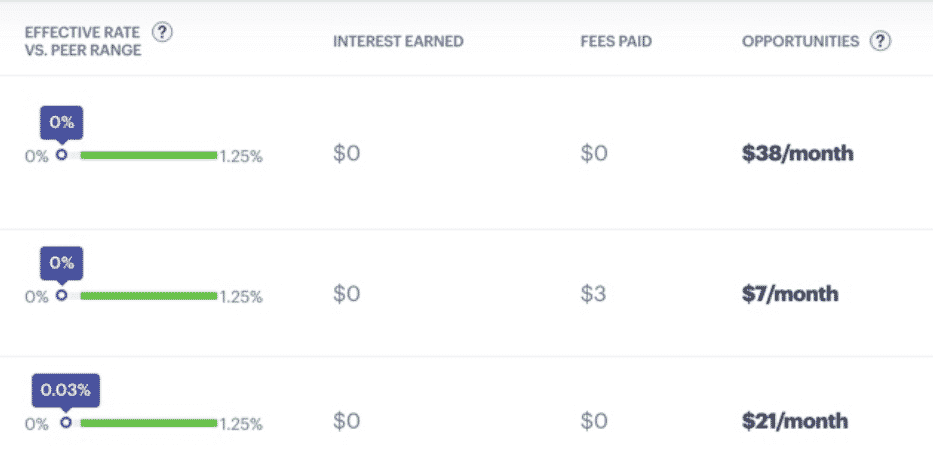

For some people an Opportunity might be to reduce spending while for others it might be to earn more on savings.

On cash balances, Opportunities will inform you specifically how much money you are missing out on based on the best rates your peers are earning.

Get Your Free Credit Score

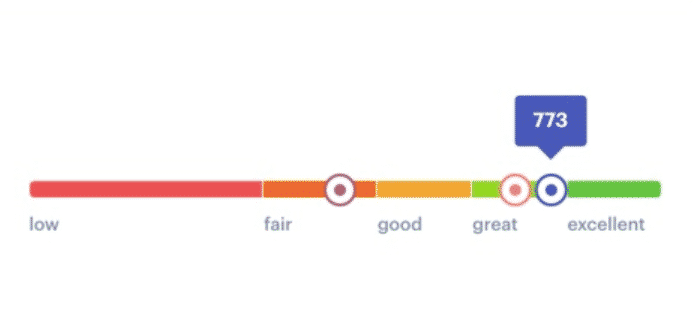

Not only does Status provide financial insights into income, expenses, assets, liabilities, and net worth, it also provides free credit scores to users.

As with financial insights, credit scores are shown in comparison to national and peer averages, so you can see where you sit relative to others.

A lower credit score means you can probably borrow at more competitive interest rates, which in turn helps you to get out of debt sooner.

Higher rates mean more of your monthly payments go towards interest versus principal.

To pay off debt, you need to lower your principal balances as much as possible. And the best way to avoid ballooning debt balances is to keep your interest charges in check.

So, a high credit score is crucial, especially if you are looking to make a large purchase like a home.

View Your Projected

Spending & Income

To keep your credit score headed in the right direction, you need to make sure your income exceeds your spending.

By spending less than you earn, you should have money left over to pay off debt balances, whether credit card debt, student loan debt, mortgage debt, or even medical bills.

The sure way to never get out of debt is to spend more than you earn each month.

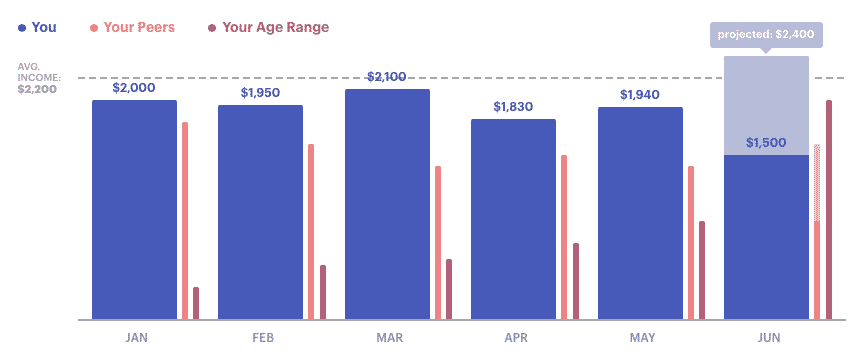

Status can help you to avoid this financial pitfall by visually displaying your spending and income levels in the past as well as projected future levels.

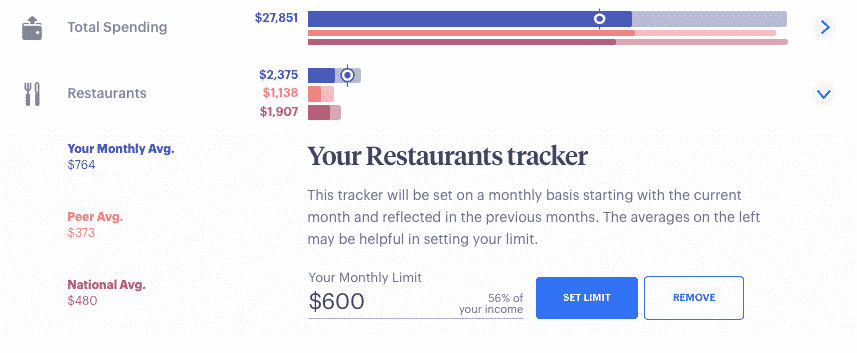

While knowing your overall spending levels is helpful, deeper insights surface when you view spending by category.

Status provides category trackers so you can see how your restaurant spending, for example, compares to your overall spending.

Keep Track Of Your Net Worth

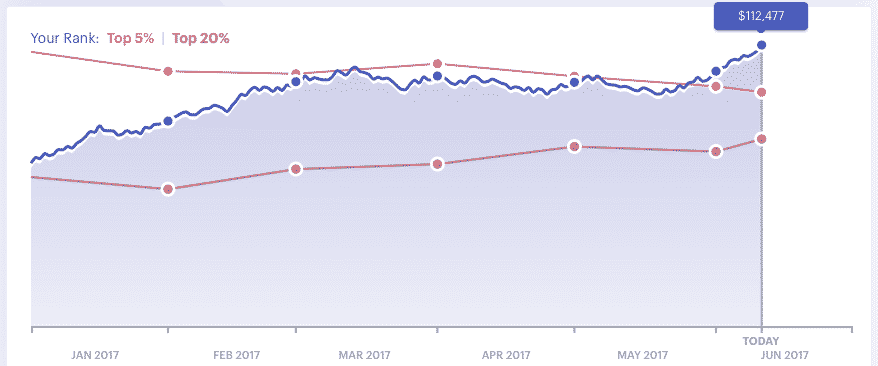

Unlike some budgeting apps that narrowly focus on expenses and income, Status tracks your net worth too.

Like spending and income categories, you can view your net worth when compared to peers and national averages also.

The graph makes it easy to spot when your net worth declines so you can take action to get back on the right track.

Best Way To Get Out Of Debt Fast

The best way to get out of debt fast is to boost your income and lower your costs.

And while that may sound obvious, the question is how would you know where opportunities exist to increase earnings on savings and lower expenses without a comparison financial app like Status?

A lot of budgeting apps spotlight your spending patterns but if you want a broader perspective to see how your finances compare to those of others in your area, your peers, or national averages, Status is your best option.

It’s easy to use, quick to get started, and best of all it’s 100% free to use so there’s no reason not to give it a whirl.